This analysis is by Bloomberg Intelligence analyst Mike McGlone. It appeared first on the Bloomberg Terminal.

Rising risk assets in 2022 may embolden a Federal Reserve facing the greatest inflation in four decades, and in the process favor Bitcoin. Crypto assets are tops among the speculative and risky, but the first born is rapidly transitioning toward becoming the world’s digital reserve asset. We expect the enduring trio — Bitcoin, Ethereum and crypto dollars — to maintain dominance. The top 2021 upcomers — Binance Coin and Solana — may end the pattern of temporary visitors among the top five.

The dog-coin speculation pumps of 2021 — Dogecoin and Shiba Inu — indicated the excesses in cryptos that are ripe for purging in 2022. The “don’t fight the Fed” mantra may already be pressuring the broad crypto market, with companionship from peaking commodities.

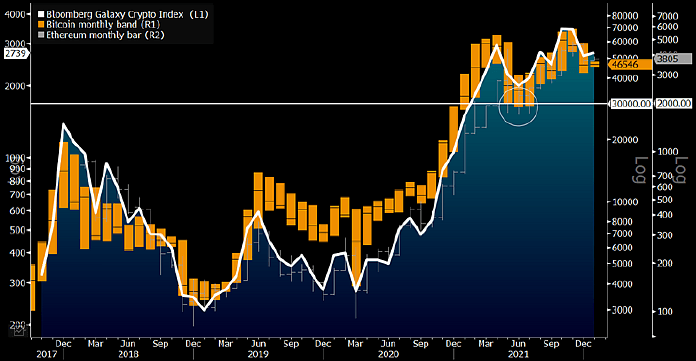

Bitcoin $30,000 and Ethereum $2,000 set underpinnings for 2022

Up about 150% in 2021, we see the Bloomberg Galaxy Crypto Index marching higher in 2022, but among the riskiest of assets, cryptos must manage Federal Reserve tightening. A top force to stop central-bank restraint is a decline in the stock market, with implications for cryptos. In most scenarios, Bitcoin may come out ahead.

Bitcoin, Ethereum have solid bases to build on

Price supports exiting 2021 of about $30,000 for Bitcoin and $2,000 for Ethereum appear solid. At about 80% of the Bloomberg Galaxy Crypto Index, we expect the top two cryptos to remain dominant and continue advancing in 2022. A risk-off swoon like that of 2020 may put those key supports in play but is unlikely. What’s more probable, we think, is Bitcoin heading toward $100,000 and Ethereum breaching $5,000 resistance. A key issue we see is the Federal Reserve, as it faces the greatest inflation in four decades, more inclined to raise interest rates if risk assets continue climbing.

Cryptos are tops among the risky and speculative. If risk assets decline, it helps the Fed’s inflation fight. Becoming a global reserve asset, Bitcoin may be a primary beneficiary in that scenario.

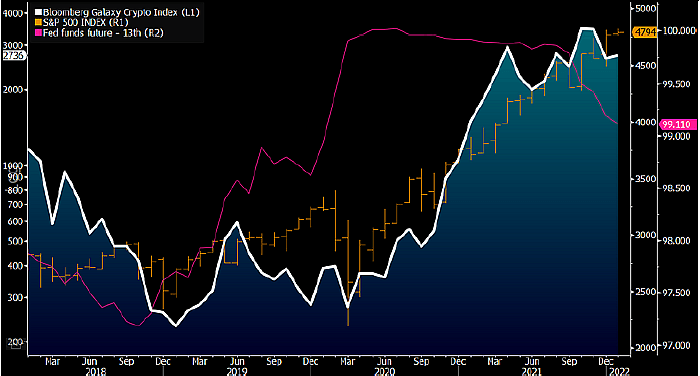

Crypto bull faces inflation-fighting Fed in 2022

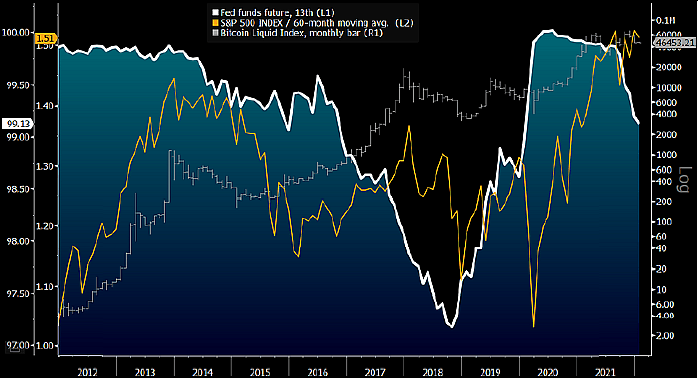

Bitcoin may gain upper hand vs. Stocks in 2022

Expectations for Federal Reserve rate hikes in 2022 may support a win-win scenario for Bitcoin vs. the stock market. Our graphic depicts the 13th fed funds future indicating a level around 1% at the end of 2022 vs. a target of zero now. A reason to take back liquidity is the fact that the S&P 500 is the most extended above its 60-month moving average in over two decades. Stretched markets have become common, but commodities and Bitcoin appear to be early reversion leaders. It’s a question of bull-market duration, and we see the benchmark crypto coming out ahead.

No supply elasticity and being in the early adoption days favor an upward bias for Bitcoin’s price, if the rules of economics apply. A top force to shift the Fed back to easing is a drop in equity prices, which supports the digital store-of-value.

Top force to stop Fed tightening – wobbly equities

Fed taking away the punch bowl and cryptos

Peaking commodities and cryptos, alongside declining Treasury yields in 4Q, may indicate normalization of stock market returns in 2022. If the S&P 500 retreats and stays down awhile, we expect Bitcoin to come out ahead, following rising bond prices and gold. Yet among the three, the digital asset has the highest volatility. Our graphic depicts the Bloomberg Galaxy Crypto Index peak in November, as federal-funds futures prices accelerated rate-hike expectations for 2022-23. Long risk assets at the start of 2022 may be fighting the Fed.

Crypto tops the speculative excesses and may be an early indicator that the broader market tide is due to recede. Peaks in meme coins Dogecoin and Shiba Inu have coincided with similar market highs, emphasizing the leading indications from crypto.

Crypto may be early warning indicator

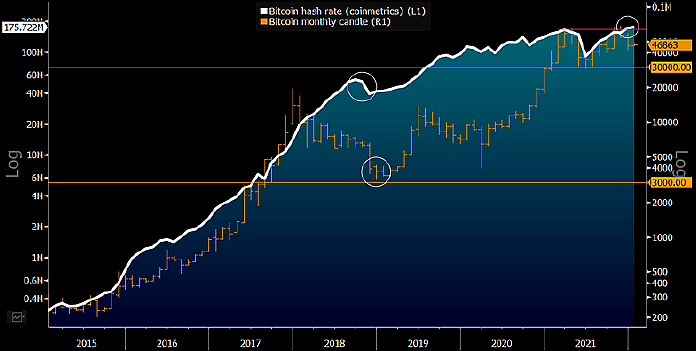

Bitcoin’s 2022 foundation rests on 2021 hash-rate reset, China

Having recovered from the 2021 hash-rate crash and price swoon, Bitcoin appears on sound footings at the start of 2022. At about the same price on Jan. 5 as in February 2021, the benchmark crypto is a consolidating bull market, as we see it, more likely to resume its enduring upward trajectory.

Bitcoin following 10x price appreciation increments

Bitcoin withstood an unprecedented plunge and subsequent recovery in its hash rate in 2021, which should solidify the crypto’s price foundation for 2022. Our graphic depicts the last time the network computing power measure from Coinmetrics had a similar decline as the roughly 50% seen last year. The hash rate’s 10-day average dropped about 30% in 2018, and Bitcoin bottomed around $3,000. In 2021, the drawdown to about $30,000 from $60,000 supports our view that the crypto should continue to appreciate in 10x increments.

As in 2018, we think the 2021 hash-rate crash solidified Bitcoin’s price foundation. Banned from China, much of Bitcoin mining has shifted to North American publicly traded companies, many of which are more inclined to hold coins, not sell them. Investors in the miners gain indirect exposure to cryptos.

$30,000 2021 Dip May Be New $3,000 From 2018