Shades of 2008 creeping into commodities, risk assets vs. Putin

This analysis is by Bloomberg Intelligence analyst Mike McGlone. It appeared first on the Bloomberg Terminal.

“Sell the fact” risks are elevated in crude oil, as Russia’s invasion of Ukraine may trigger a global recession and destroy demand. We see parallels to the 2008 Brent crude peak around $146 a barrel, which ended that year closer to $40. The U.S. was the world’s largest crude importer 14 years ago and has shifted to exporter, while China is the top importer now but is mired in a real estate crisis, and is shifting rapidly to electric vehicles and likely to absorb Russian crude exports. Demand shocks may outweigh supply risks. Gold stands to be a primary beneficiary, notably if equities follow U.S. Treasury long bond yields lower.

The inability of copper to sustain above $10,000 resistance may mark a similar ceiling as $100 crude oil. What’s more certain is a boom for North American commodity suppliers.

Putin and ‘sell the fact’ risks another 80% crude oil price drop

Sometimes it just takes a spark for stretched markets to revert toward longer-term means, and 2022 may have two — Russia’s invasion of the Ukraine and the Federal Reserve fighting inflation. We see elevated risks of 2008-like price reversion in 2022. It was the price spike in crude oil 14 years ago that accelerated drawdowns in most risk assets.

Demand destruction vs. Supply reduction?

Top binary options for the rest of 2022 include a supply shock to crude oil due to Russia’s invasion of Ukraine, or recession-related demand destruction pressuring prices, with our bias to the latter. It’s not profound to point out the potential for Brent crude to drop about 80%, which it has three times since peaking around $147 a barrel in 2008. The energy crisis in Europe beginning in 2021 and Russia-Ukraine war in 2022 are ample reason for a sharp backup in global economic growth and the price of crude oil. Brent crude oil around $100 a barrel may have entered a lose-lose stage.

The new world order is likely to shift liquid-fuel flows (Russia to China) rather than cut supply. What’s more certain is North American producers gaining plenty of impetus. Copper $10,000-a-ton resistance appears similar to $100 crude.

Crude oil risks decline with global GDP

Putin may spark $30 crude oil – Risks of another 80% drawdown

The crude oil market is likely to mirror past reversion patterns from elevated prices. Brent crude has dropped about 80% on three occasions since the 2008 peak. It’s possible that Russia’s invasion of Ukraine triggers global recession and accelerates electrification and decarbonization trends.

Patriotism, production, war and crude reversion risks

Brent crude oil around $100 a barrel may have entered a lose-lose stage. Despite a substantial rally from the 2020 swoon and Russia’s invasion of Ukraine, the fact that the price near the start of March would need to increase about 50% to reach the 2008 peak is indicative of bigger-picture headwinds. The front Brent future at about triple the average U.S. shale cost of production around $33 a barrel and the ability of suppliers to hedge a few years out over double costs portends the profits and supply to expect. We see spiking energy prices in 2022 akin to 2008, just before the collapse, but with demand tilting unfavorably due to the war.

The new world order is likely to shift liquid fuel flows (Russia to China) rather than cut supply. What’s more certain is North American producers gaining plenty of impetus.

Crude reversion risks akin to 2008, 2014, 2018

Gold $2,000 vs. Copper $10,000: Precious gaining 2022 upper hand

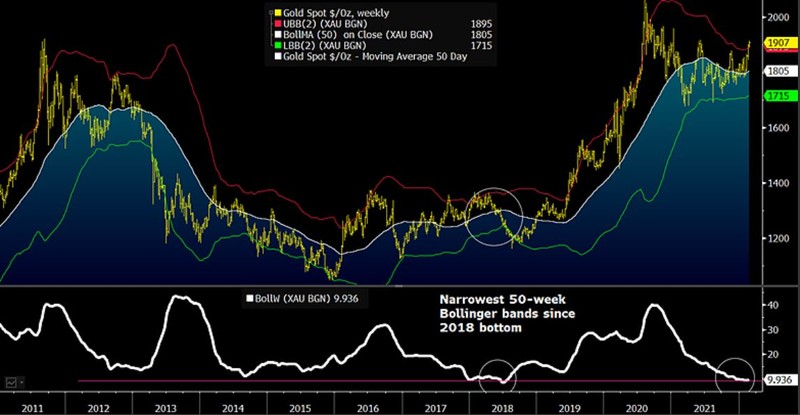

Strong industrial metals at the start of 2022 risk reversion with crude oil and set the stage for gold to breach $2,000-an-ounce resistance. Copper’s inability to breach last year’s highs along with the U.S. Treasury long-bond yield may indicate a bigger slog of risk-asset underperformance necessary to alleviate inflation.

Gold is poised to cross the $2,000 rubicon

Gold is a prime candidate to follow the pattern of commodities that trade within narrowing wedge patterns — they have a tendency to break out to the upside. The 2021 range of about $1,700-$1,950 an ounce roughly matches the 50-week Bollinger bands, which are the narrowest since 2018. We see parallels to the pattern that formed a foundation of around $1,200 some four years ago and subsequent breakout above $1,400 in 2019, when the Fed started easing again. About $1,800 is a strengthening base for a potential breach of $2,000 resistance.

Markets may be facing an extended risk-off reversion period, which we see as essential to reduce inflation pressures. Gold stands to be a primary beneficiary, potentially along with U.S. Treasury long bonds and Bitcoin.

Gold likely exits cage through the top

Great North American agriculture commodity boom gaining momentum

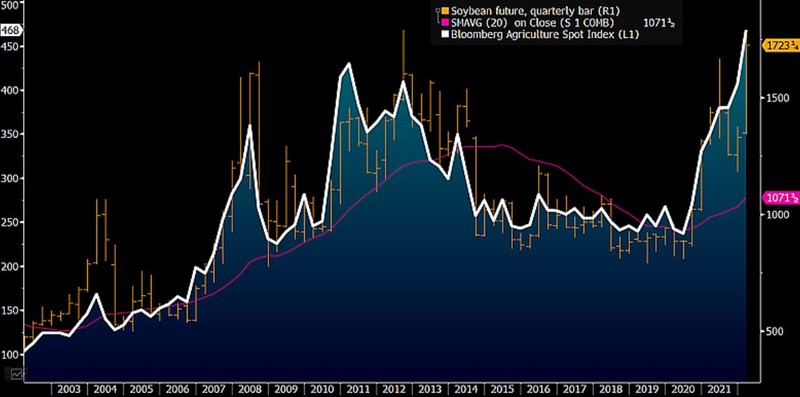

There’s potential that Russia’s invasion of Ukraine may trigger a global recession, yet tilt grain and agriculture demand to a more reliable North America. The most-elevated grain prices ever as Corn Belt-planting decisions are being made could encourage a record crop with implications for profit and supply-related price headwinds.

The high-price cure may be less effective

The typical high-price cure in the primary supply-elastic commodities — grains — may be less effective this time. Russia’s invasion of Ukraine, a combined top wheat and corn exporter, appears likely to maintain an underlying bid below the market. Our graphic depicts the propensity for soybeans and grain prices to revert lower from new highs — about 50% from the 2008 and 2012 peaks. Prices could peak in May-June, yet we see foundations rising around last year’s lows of about $12 a bushel in soybeans and $5 in corn.

The benchmark corn, soybean and wheat futures make up the bulk of the Bloomberg Agriculture Index and traded in dollars and delivered in the U.S., emphasizing the North American focus of agriculture markets.

Record corn belt production and profit likely